From Cybersecurity to Cyber Resilience.

Meeting a growing threat

By 2025, companies globally are expected to spend ~$1.75 trillion on cybersecurity-related tools and services. However, the costs of global cybercrime over the same period are expected to be even higher—$10.5 trillion (Cybersecurity Ventures, 2020).

Evolving alongside cyber risk

To succeed in this fast-paced and ever-changing landscape, businesses must adopt a holistic approach to assessing, measuring, and managing cyber risk.

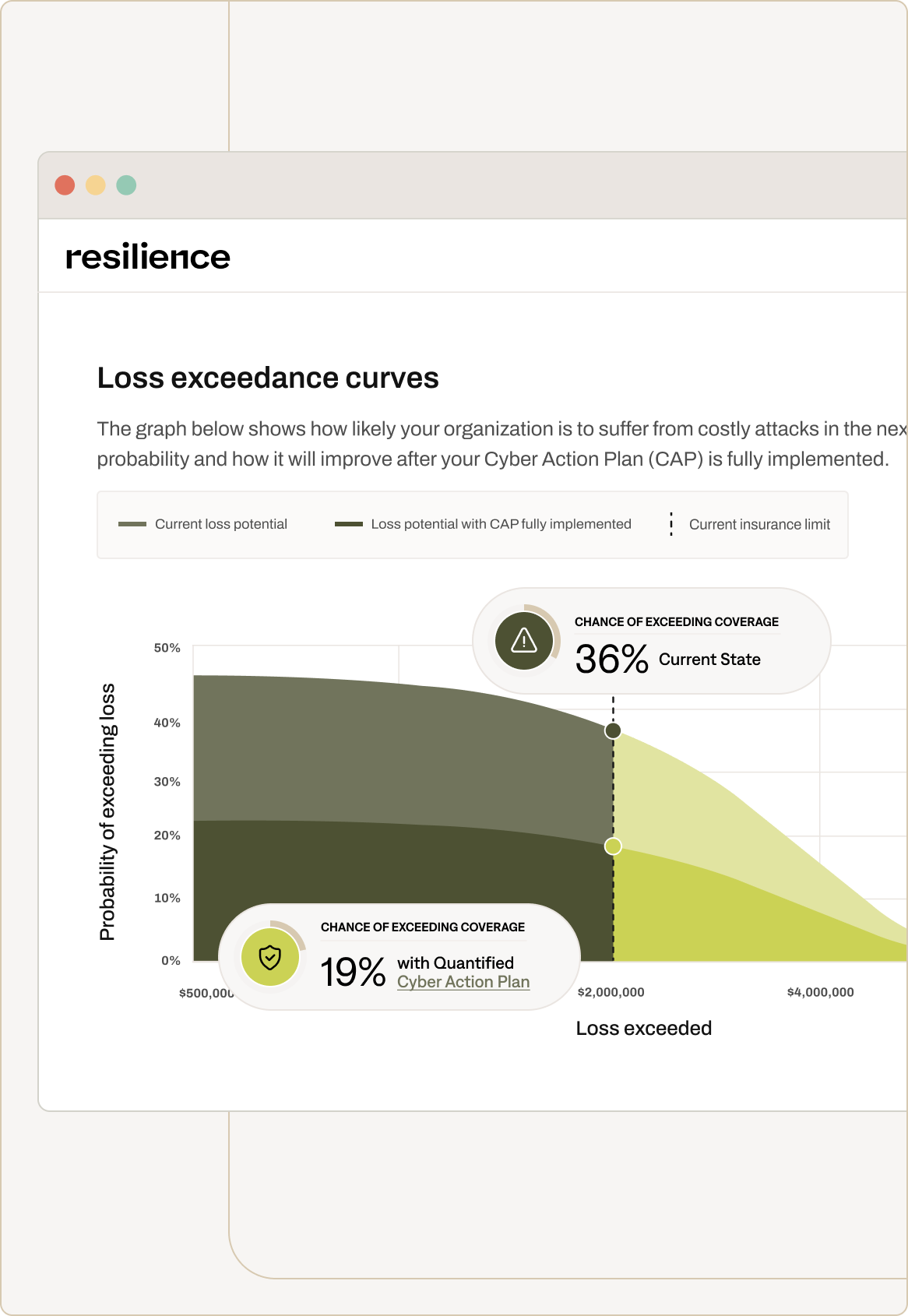

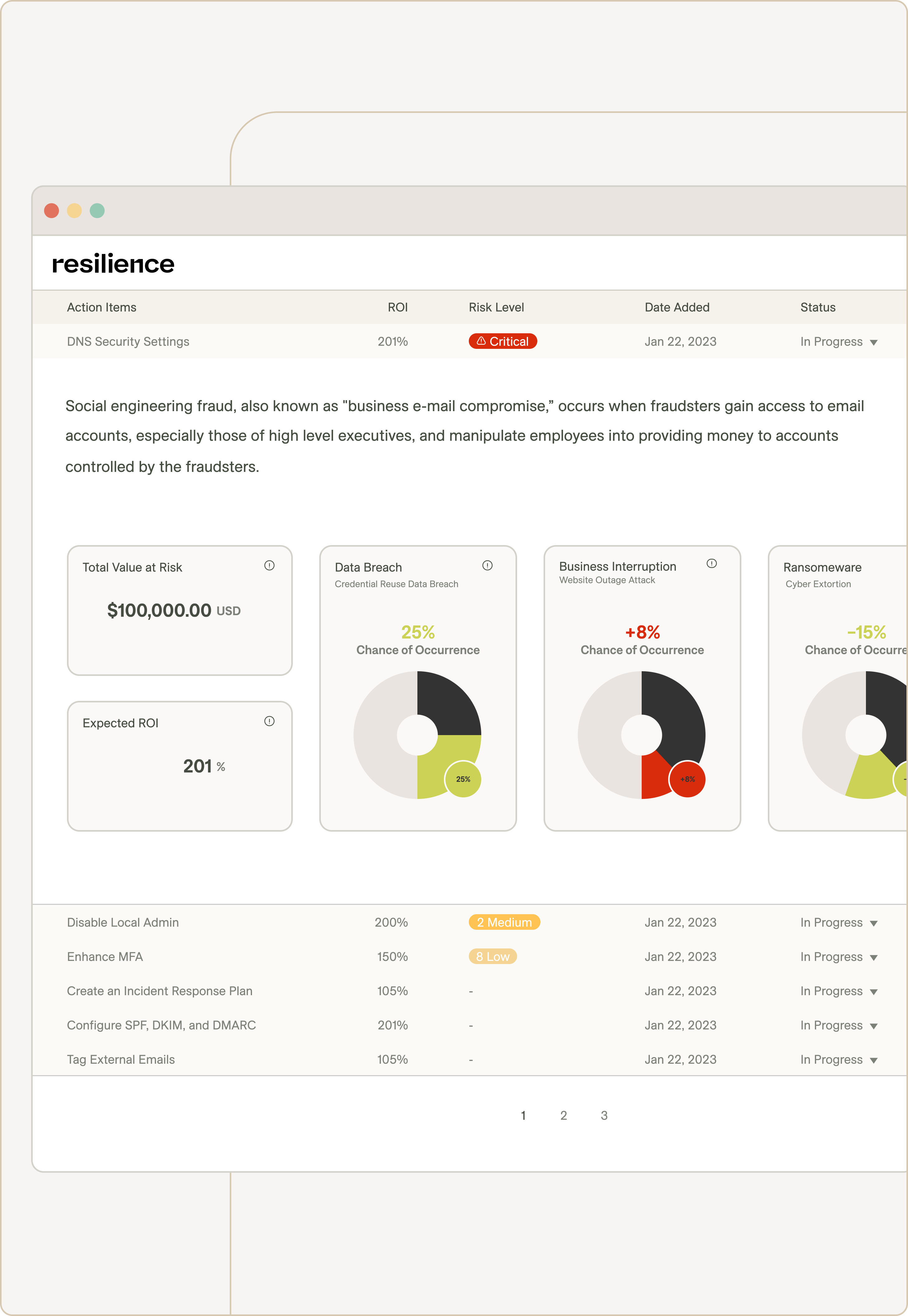

Risk as a financial problem

When evaluating risks, it’s crucial to delve beyond the basic categories of “low,” “medium,” and “high.” To accurately gauge the level of risk, teams must compute the likelihood of threats and leverage that data to decide on the right security measures and insurance investments.

The Resilience Solution

Cybersecurity alone isn’t enough. Instead, organizations should focus on Cyber Resilience – balancing technical security measures with the proper level of insurance, while accepting certain predictable risks within a company’s appetite.

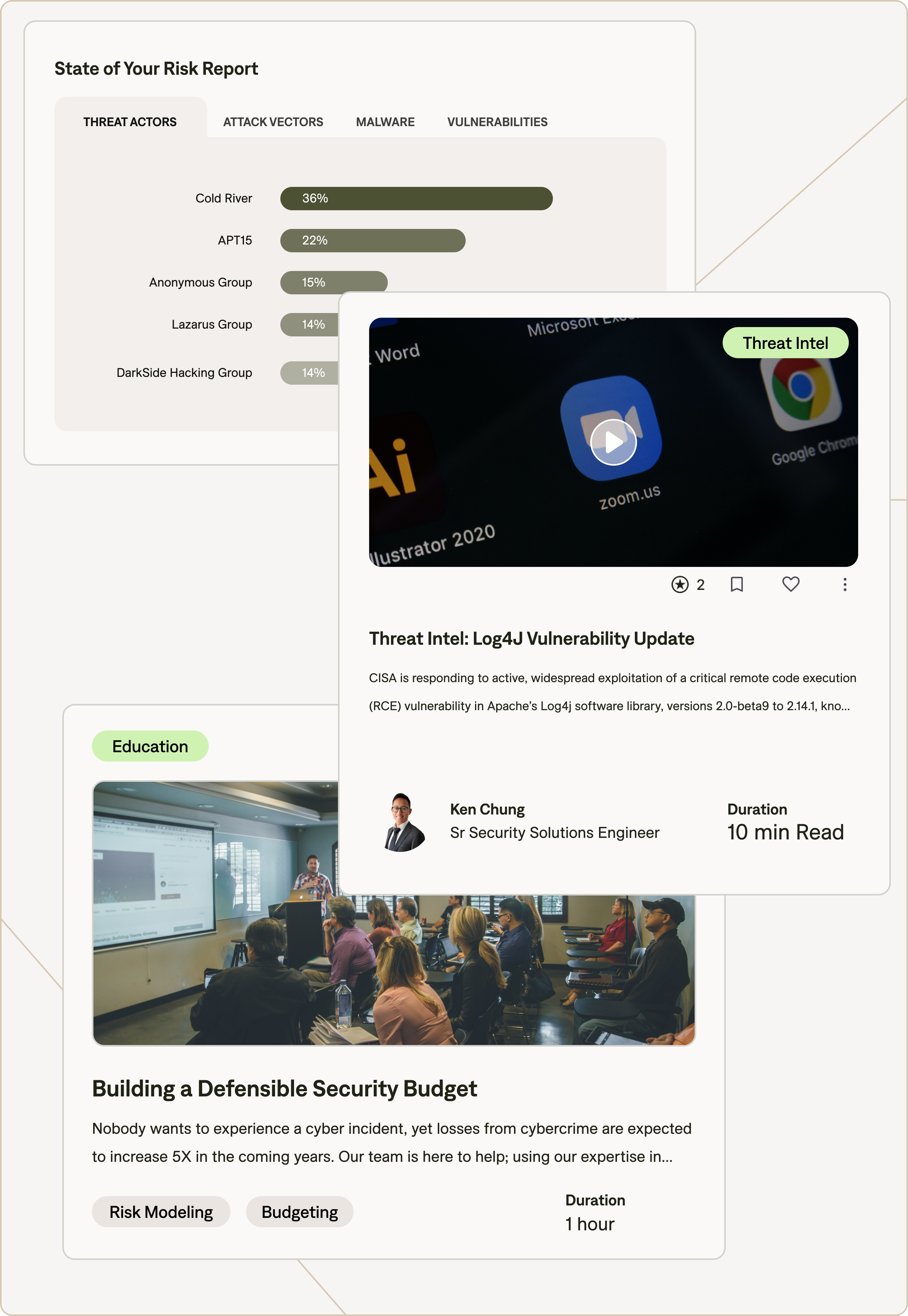

Align your risk, finance, and security teams with one integrated solution.

See Case Studies

For Risk Managers

Our solution helps risk managers to gain a better understanding of their loss tolerance and balance their risk transfer spending with security protocols

For CISOs

Our solution makes it easier to translate cybersecurity threats into financial risks for CFOs and Board of Directors

For CFOs

Our solution helps quantify an organization’s value-at-risk, addressing both the financial and technical challenges of cyber risk management

2023 Claims Report Shows The Impact of Cyber Resilience

- Only 15% of Resilience clients who were impacted by ransomware needed to pay an extortion, half the average rate seen in the market.

- Big Game Hunting by ransomware actors is back as criminals are pressured by declining extortions payment.

- Third party vendors are being leverage to launch encryption-less extortion, as seen in the MOVE it attacks.

The five elements of

Cyber Resilience

Clarity

Plan cyber investments based on quantified risk and financial impact scenarios, rather than historical trends

Context

Proactively prioritize risk and mitigate threats based on business impact

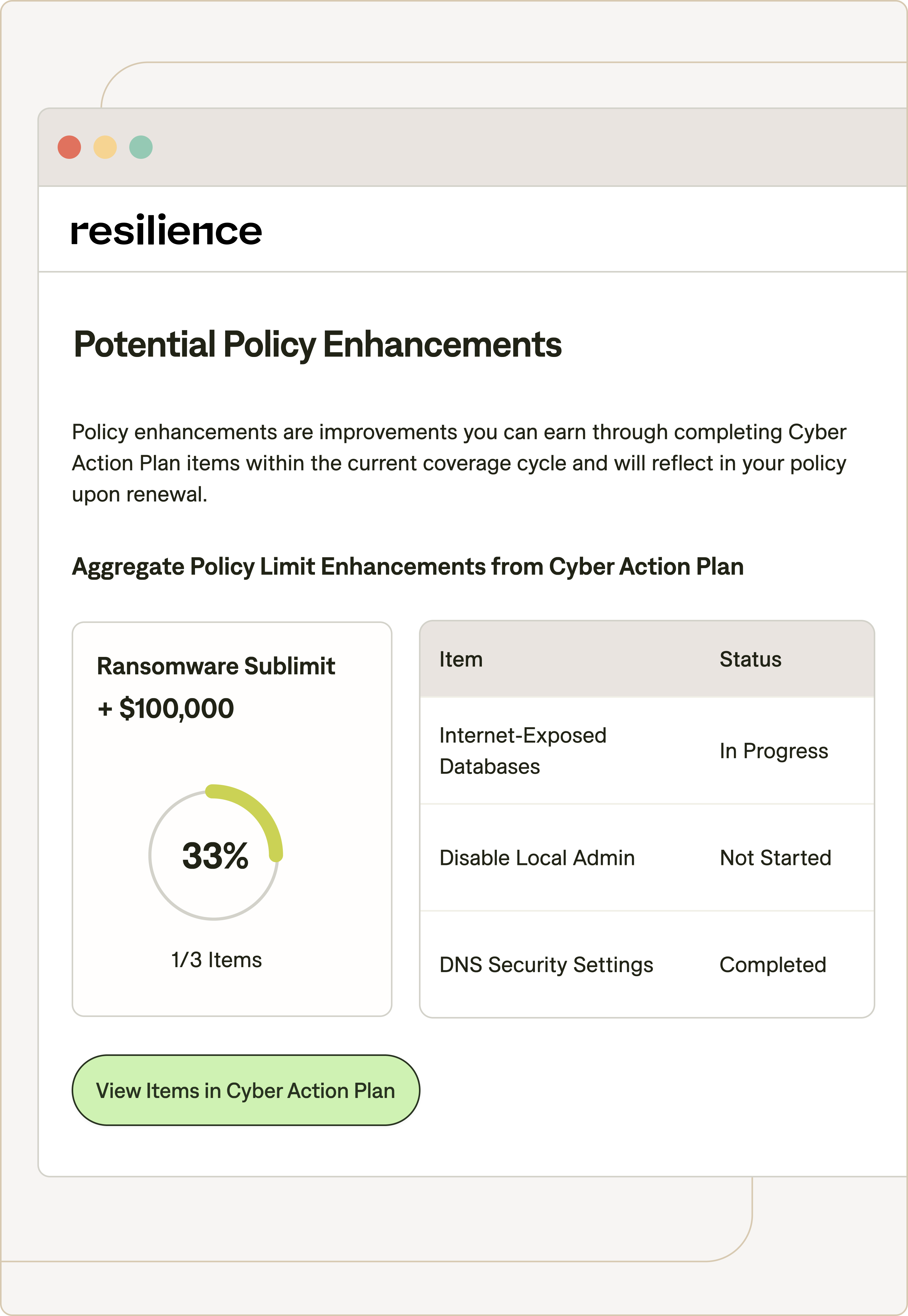

Coverage

Get a comprehensive policy that evolves to future risks as your business grows

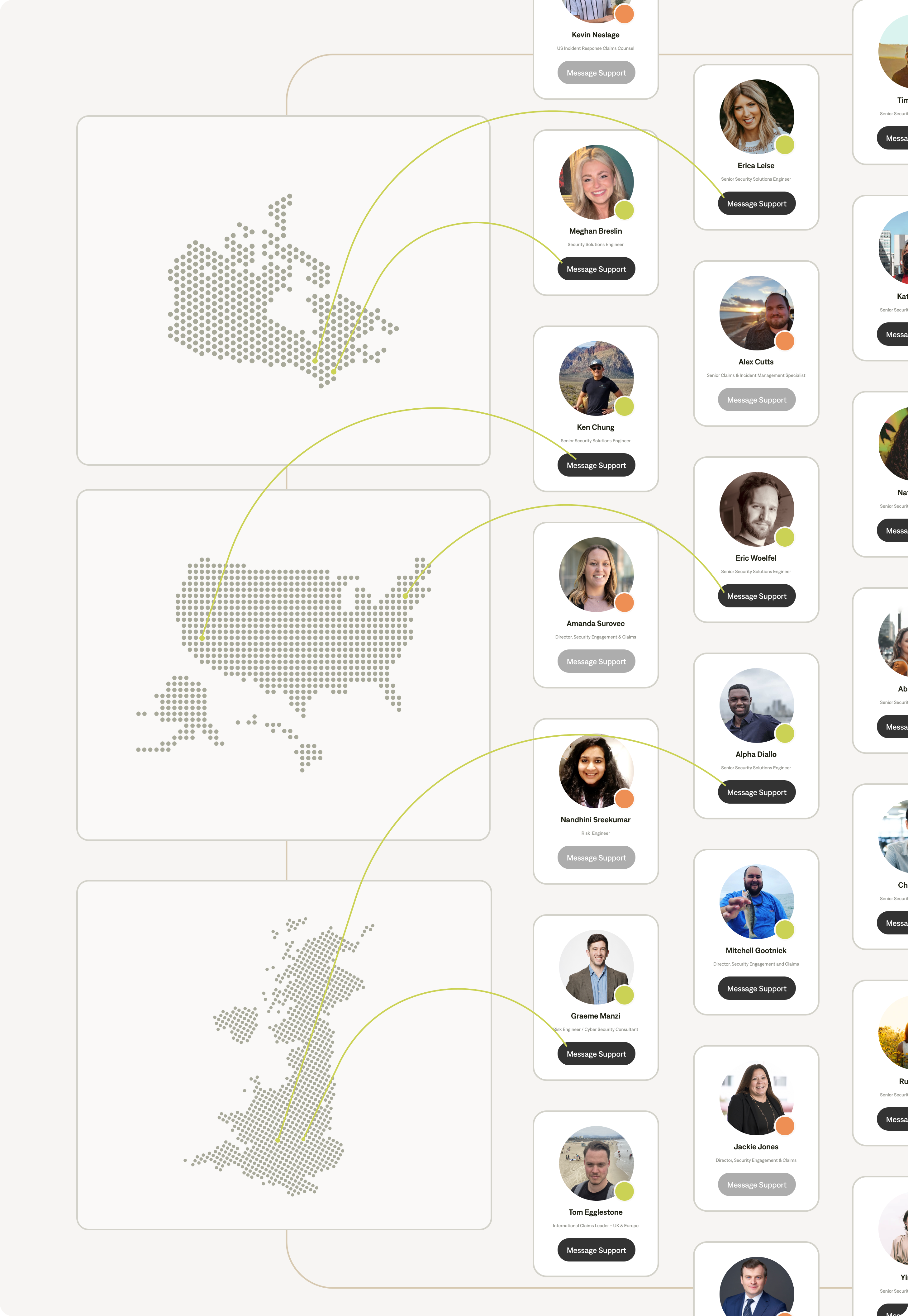

Counsel

Continuously engage with experts across cybersecurity, operations, and insurance to plan for and navigate through cyber incidents

Community

Create advocacy among key stakeholders up and down your organization